What Bookkeeping and Accounting Course Can I Study?

Searching for the best accounting courses through distance learning? Here is your complete list of ICB recognized accounting and bookkeeping courses:

| NQF Level | ICB Programme Level | Qualification |

| NQF L3 | Foundation Level | National Certificate: Bookkeeping |

| NQF L4 | Intermediate level | Further Education and Training Certificate: Bookkeeping |

| NQF L5 | Upper Intermediate level | National Diploma: Technical Financial Accounting |

| NQF L6 | Advanced Level | National Diploma: Financial Accounting |

The difference between Bookkeeping and Accounting

Accounting and Bookkeeping are 2 sides of the very same thing. At the entry level, it is called bookkeeping. In accounting, you are working with the precise recording of all the deals of a service or department. You ensure that incomes an all expenditure are correctly tape-recorded.

When you have actually moved a couple of steps up on the ladder, you start reporting on the bookkeeping details, and you begin assessing the info. At the level where your task becomes more complex given that you are also reporting and examining company financial information, we begin calling it Accounting.

So an Accountant is a senior Bookkeeper. And a Bookkeeper is a junior Accountant!

Why Study Bookkeeping?

In South Africa, accounting and accounting are scarce skills. That implies that both industry and federal government acknowledge that we have a shortage of accountants and accounting professionals. The federal government body for certifications in the monetary sector, FASSET, has actually done a study on scarce skills in 2015. From that study, they released their Scarce Skills Guide 2015.

FASSET is the SETA for Finance, Accounting, Management Consulting and other Financial Services. In their scarce skills assist they identified the following as scarce skills:

- Trainee Accountant

- Finance Manager

- General Accountant

- Accounts Clerk

- Payroll Clerk

- Financial obligation Collector

These are all positions for which an ICB accounting course will prepare you appropriately. Your accounting accreditation will guarantee that you are continuously in demand. It is a fantastic career that can take you to the highest level in an organisation.

The deficiency of accounting abilities also impacts federal government departments. All government departments have accounting and accounting divisions. And they work every year to obtain an effective audit. To get a clean audit implies that they need skilled, certified, dedicated and experienced bookkeeping and accounting personnel and supervisors.

As a certified accountant or accounting professional, you will continuously stay in demand. Either in personal business or in a federal government department, which can consist of both municipalities, along with larger national federal government departments.

Can I study ICB Bookkeeping if I don’t have a Matric Certificate?

Yes, you can study ICB Bookkeeping without Matric.

All the ICB courses begin at NQF level 3. And they go up to NQF level 6. In comparison, matric is at NQF level 4. So these courses are available for a student who do not have matric. Trainees start at a level listed below matric. Keep studying the programme, and course by course you will rise the NQF level 6, which is two levels higher than matric.

The ICB has developed their courses to help students who did not complete school, and who has to work and study at the same time. So you start with the simple principles and work, and construct on that foundation, till you are eventually a professional!

As a home study student, you can study an hour after work, 3 or four times weekly. With five assessment chances in 2017, you know that as quickly as you are all set, you can sign up for the next test.

This is how you construct up your certifications; action by step.

As you advance through the program, you will get acknowledgment at the different levels. After completing the first 4 subjects, you will get your really first qualifications from FASSET, and your first ICB Programme Certificate.

ICB Courses Offered At Matric College

If you are looking to further your studies in the financial or business management field, the ICB courses are just what you are looking for. There are 3 study programs offered to Matric College students and they are:

- Financial Accounting

- National Certificate in Junior Bookkeeping

- FET Certificate in Senior Bookkeeping

- National Diploma in Technical Financial Accounting

- National Diploma in Certified Financial Accounting

- Business Management

- Small Business Financial Management: ICB National Certificate

- Business Management Office Administration: ICB Higher Certificate

- Business Management Financial Accounting: ICB National Diploma

- Office Administration

- National Certificate in Small Business Financial Management

- Higher Certificate in Office Administration

- National Diploma in Financial Accounting

ICB Bookkeeping and Accounting Courses

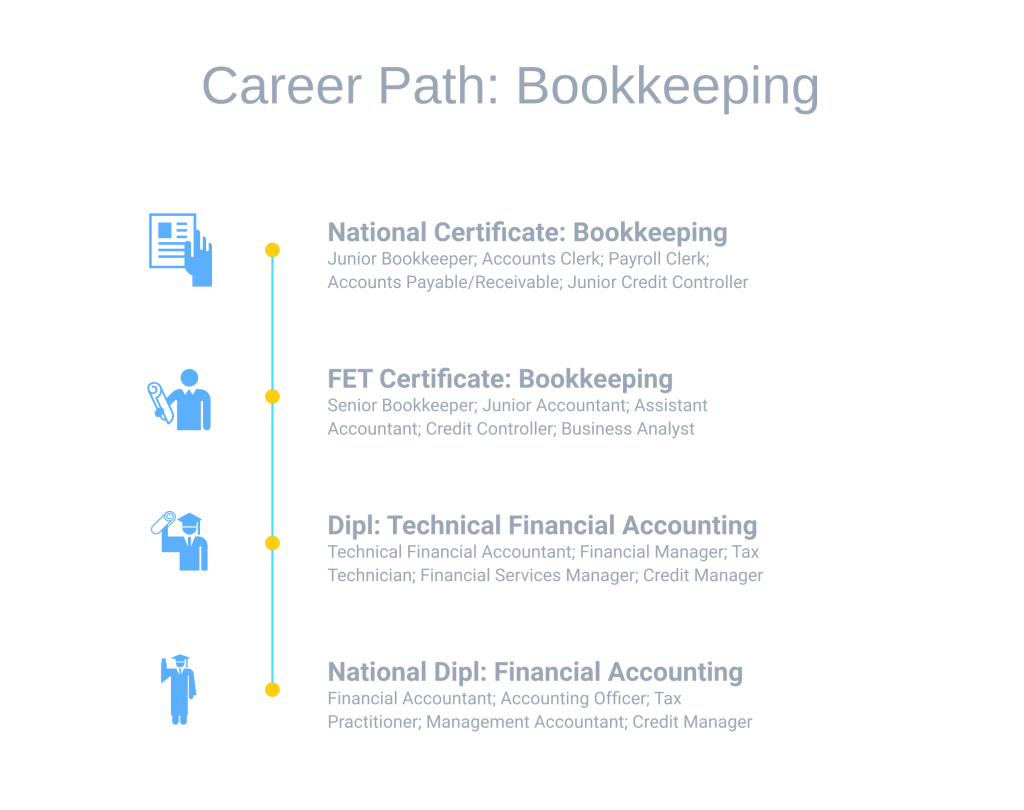

The ICB bookkeeping and accounting program is made up of four various levels. Inside each level can be one or more courses.

- Foundation Level

- Intermediate Level

- Upper Intermediate Level

- Advanced Level

As you total each level, you will get accredited by the ICB. You will get an ICB Certificate. As you complete the different courses inside the levels, you will get acknowledgment from FASSET in the kind of your official certification from FASSET.

Foundation Level

Wish to study to become a Junior Bookkeeper?

Our ICB National Certificate in Bookkeeping course is best for students who wish to operate in a junior bookkeeper position. This course consists of four topics and will take sixteen months to complete. In order to study this course, you have to be at least sixteen years of age and have a grade 10 certificate. No previous bookkeeping or accounting knowledge is required.

National Certificate: Bookkeeping (NQF Level 3) – Foundation Level

The foundation level is the beginning point for many trainees. If you did refrain from doing that well at school, or you stopped trying matric, or you have in fact not studied for numerous years, then the foundation level helps you bridge the gap and get back into studying.

Academically the level is NQF 3. That is the level listed below matric, so we understand that students with Grade 10 (Standard 8) will have the ability to handle the scholastic level of the work.

You do not require any previous accounting or accounting understanding if you start at this level. And you need being at least 16 years of age to be accepted into the program.

To complete this level you should pass four topics. The recommended time to finish this level is 12 months. Distance learning students can use up to 18 months.

Intermediate Level

Wish to study to become a Senior Bookkeeper?

The ICB Further Education and Training Certificate in Bookkeeping course will prepare you for a senior bookkeeper position. The entry requirement for this course is a National Certificate in Bookkeeping. The study duration for this course is six months and there are only two subjects to complete.

FET Certificate: Bookkeeping (NQF level 4) – Intermediate Level

The intermediate level is for students who have successfully finished the foundation level. It is your 2nd action on the ladder to ending up being a Financial Accountant.

To enter this level, you should have passed the foundation level. That indicates you must currently have your National Certificate: Bookkeeping to enter this level.

To finish this level you have to pass 2 topics. Various trainees total this level in 6 months. Distance learning students can consume to 9 months to complete this level.

Upper Intermediate Level

Wish to study to end up being a Technical Financial Accountant?

To become a qualified technical monetary accountant, you ought to study the ICB National Diploma in Technical Financial Accounting course. In order to study this accounting course, you first need to acquire a Further Education and Training Certificate in Bookkeeping. This course takes about 6 months to finish and there are 2 topics to work through.

National Diploma: Technical Financial Accounting (NQF level 5) – Upper Intermediate Level

At this level, you move from Bookkeeper to Accountant. If your dream is to wind up being an Accountant, then this level will get you there!

To enter this level you require to have passed the Intermediate level. That suggests you should have your FET Certificate: Bookkeeping to obtain entry to the Upper Intermediate Level

To complete this level you have to pass 2 subjects. The advised time of study is 6 months. Home Study students can consume to 9 months to complete this level.

Advanced Level

Wish to study to become a Financial Accountant?

If you are dreaming about running your own bookkeeping/accounting practice, you need to study the ICB National Diploma in Financial Accounting. You need a National Diploma in Technical Financial Accounting to study this course. You will have to finish three topics in the period of 9 months.

You could also study the general public Sector National Diploma in Financial Accounting course to obtain a financial accountant classification. Nevertheless, you initially have to complete the National Certificate in Public Sector Accounting and Diploma in Public Sector Accounting course before you can continue to the financial accounts course. This course will also take nine months to complete.

National Diploma: Financial Accounting (NQF level 6) – Advanced Level.

This is the greatest level of ICB studies. Here you will get your National Diploma: Financial Accounting (NQF Level 6). To enter this level you need to have passed all the previous levels. So that means you need to be in possession of your National Diploma: Technical Financial Accounting.

To pass this level you should successfully complete four subjects. Trainees normally take around 12 months to complete this level. Distance learning students can take a bit longer, clearly.

ICB Correspondence Colleges – Accreditation

Being completely recognised ways that the college has actually gotten accreditation to the Institute of Certified Bookkeepers. After sending a portfolio of documents to validate the application, each college is gone to by a quality control manager from the ICB. At the college site a range of things are checked, to make sure the college is efficiently able to provide these ICB courses.

Some of the crucial things a college must show at a site assessment from the ICB are their financials, quality study materials, appropriate systems and processes to provide distance learning, certified personnel, a tax clearance certificate and an OHS certificate to show that the college is safe for staff and trainees.

After successfully passing the site examinations, these colleges got their accreditation from the ICB. That implies they have an accreditation certificate for each ICB program that they are acknowledged to provide.

ICB Learner Portal

The ICB has a student website for home study trainees. Through the ICB trainee website, you can access a variety of self-service functions. You can likewise ask your college to access these functions in your place if you do not have internet access to, or if you have a difficult time to utilise the portal.

A few of the important things you can do via the student portal are:

- View and modify your personal and contact details

- Order a reprint of a certificate you accomplished

- Pay your ICB costs (Credit Card).

- Register for Exams.

- See your Exam Results.

ICB Bookkeeping Courses Fees.

There are a variety of various expenses that you must plan for if you are going to study an ICB course. Here are some of the major expenses you need to understand and prepare for:.

- Study fees with your distance learning college.

- Textbook charges. Some colleges will include this in your course charges.

- Courier costs. Skills Academy includes this in your course charges.

- Exam charges. Typically, you pay this directly to the ICB, so it is not included in your course costs.

- ICBA Student Membership fees. These charges are usually not consisted of in your course charges.

- ICB Student Registration costs. This is a yearly fee that is generally not included in your course costs.

ICB Registration.

When you decide to study an ICB credentials, you require to remember a number of things that all form part of your ICB Registration, being:.

- Yearly ICB Student Registration.

- Registration with a home study college.

- ICB Exam Registration.

ICB Exams.

The ICB provides 5 exam sessions to home study students in 2017. You must make sure you comprehend the examination charges. And it is critically important that you sign up for your test, three months before you prepare to write the examination.

You can not get here at the test centre and anticipate a seat and an exam paper if you have actually not registered for that examination.

Last Updated, 13 December 2021