Bookkeeping Courses South Africa

Looking for Bookkeeping in South Africa via Distance Learning? Here is the total list of Institute of Certified Bookkeepers courses that you can study from anywhere in South Africa.

- National Certificate: Accounting

- FET Certificate: Accounting

- National Diploma: Technical Financial Accounting

- National Diploma: Financial Accounting

- National Certificate: Small company Financial Management

- National Certificate: Public Sector Accounting

- Diploma: Public Sector Accounting

The Institute of Certified Bookkeepers offer a range of accounting courses. You can start at an academic level listed below Matric, and work you method as much as two levels higher than matric (NQF 6 level).

To comprehend the ICB Bookkeeping courses, you have to consider the following:

- Why study Accounting?

- Can I study ICB Bookkeeping courses if I do not have Matric?

- The difference between Accounting and Accounting Courses

- The different levels of study with the ICB

- The various courses that makes up the ICB Financial Accounting Programme

- Foundation Level

- Intermediate Level

- Upper Intermediate Level

- Advanced Level

- What certifications do you get?

- Study even more after completing your programme

- Subjects that are the same across more than one ICB course

- The role of your college and the role of the ICB – who does exactly what?

- How does Home Study or Distance Learning work for these courses?

Why Study Bookkeeping in South Africa via Distance Learning?

In South Africa bookkeeping and accounting are scarce skills. That implies that both industry and government acknowledge that we have a lack of accountants and accounting professionals. The government body for qualifications in the monetary sector, FASSET, has done a study on scarce skills in 2015. From that study they published their Scarce Skills Guide 2015.

FASSET is the SETA for Financing, Accounting, Management Consulting and other Financial Solutions. In their scarce skills assist they identified the following as scarce skills:

- Trainee Accountant

- Finance Manager

- General Accounting professional

- Accounts Clerk

- Payroll Clerk

- Financial obligation Collector

These are all positions for which an ICB accounting course will prepare you appropriately. Your accounting credentials will make sure that you are always in need. It is a terrific profession that can take you to the highest level in an organisation.

The deficiency of accounting abilities also affects federal government departments. All government departments have accounting and accounting divisions. And they work every year to get a “clean audit”. To get a clean audit suggests that they need well-trained, certified, dedicated and experienced accounting and accounting staff and managers.

As a qualified bookkeeper or accountant, you will constantly be in demand. Either in private service, or in a federal government department, which can include both municipalities, along with larger national government departments.

Can I study ICB Accounting courses if I do not have Matric?

The bookkeeping courses start at NQF level 3. And they go up to NQF level 6. Matric is at NQF level 4. So these courses are accessible for student who do not have matric. You start at an academic level below matric. And if you continue studying, you will end up with a credentials 2 levels above matric.

The ICB courses are developed to be accessible for students who should work and study at the exact same time. With distance learning you can study an hour every evening. You now have 5 test chances annually, so as quickly as you are ready for a test, you can go and write that exam. In this way you can do your course action by step.

As you advance with the programme, you will get recognition at the various levels. After finishing the very first 4 topics, you will already get your first credentials from FASSET, and your very first ICB Programme Certificate.

The difference between Bookkeeping and Accounting Courses

Accounting and Accounting are two sides of the same thing. At the entry level, it is called accounting. In bookkeeping you are hectic with the precise recording of all the deals of a business or department. You ensure that all income an all expense are correctly tape-recorded.

When you have moved a couple of steps up on the ladder, you start reporting on the accounting details, and you begin evaluating the details. At the level where your task ends up being more complex, due to the fact that you are likewise reporting and analysing business financial information, we start calling it Accounting.

So an Accounting professional is a senior Bookkeeper. And a Bookkeeper is a junior Accountant!

The various Levels of study with the ICB

The ICB accounting program is divided into different levels. Inside each level can be one or more courses. The programme is divided into 4 levels, as follows:

- Foundation Level

- Intermediate Level

- Upper Intermediate Level

- Advanced Level

As you total each level, you will get acknowledgment from the ICB in the form of an ICB Program Certificate. As you finish the various courses inside the levels, you will get acknowledgment from FASSET through your official certification from FASSET.

I shall explain the different levels, and the courses inside each level, in information below.

The different Courses that makes up the ICB Financial Accounting Programme

The ICB Accounting/ Financial Accounting Program is burglarized 4 levels. Inside each level is one complete certification. As you advance up the ladder of qualifications, you will see the names of the qualifications alter from Accounting to Accounting.

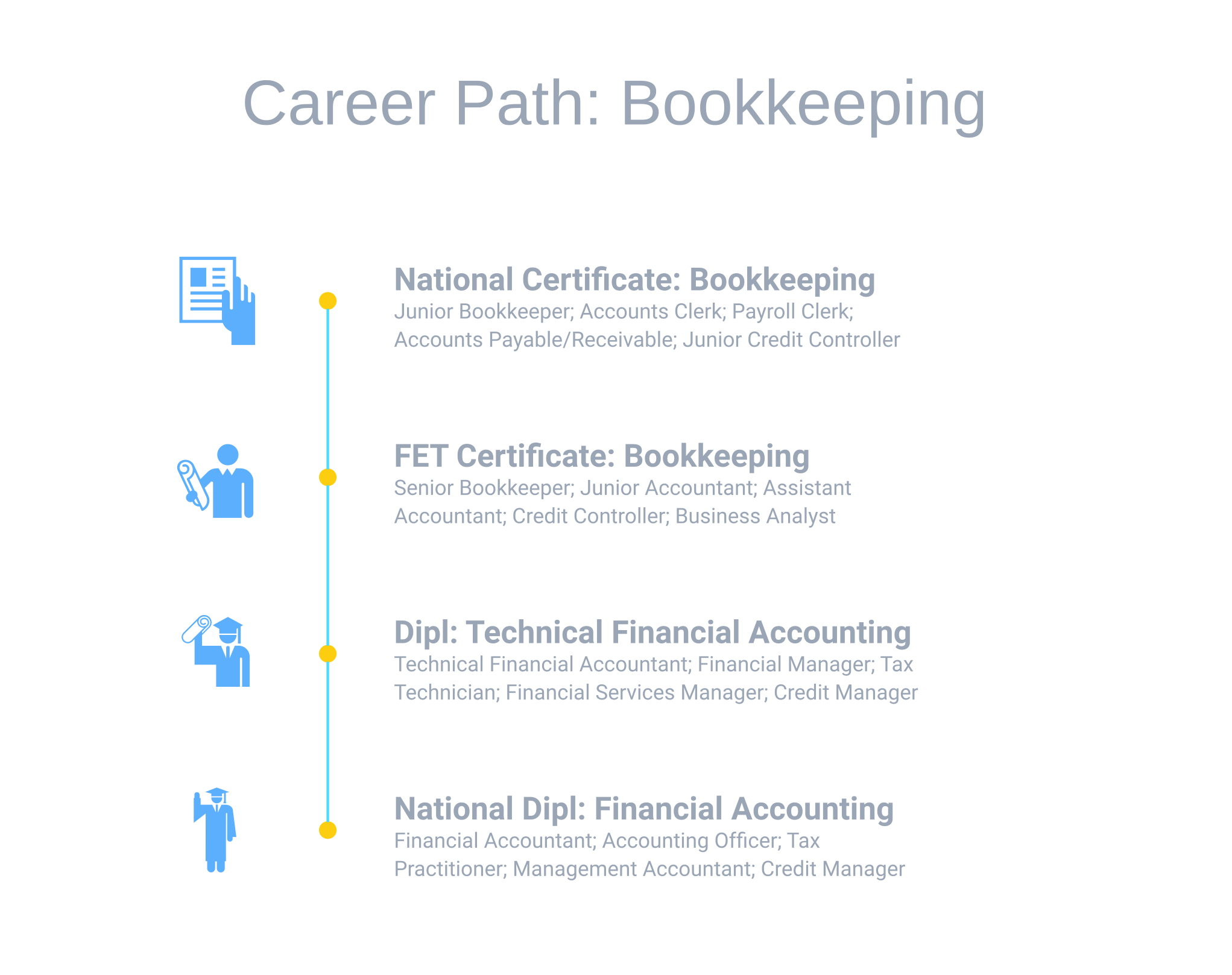

The ICB Financial Accounting Program consist out of 4 different levels, each with a FASSET credentials inside it; as follows:

- Foundation level – National Certificate: Bookkeeping (NQF Level 3).

- Intermediate level – FET Certificate: Accounting (NQF level 4).

- Upper Intermediate level – National Diploma: Technical Financial Accounting (NQF level 5).

- Advanced level – National Diploma: Financial Accounting (NQF level 6).

Accounting Courses.

In the ICB, we refer to the Foundation and Intermediate level courses, as Bookkeeping courses. So that will be these two qualifications:

- National Certificate: Accounting (NQF Level 3).

- FET Certificate: Accounting (NQF Level 4).

Accounting Courses.

Accounting courses in the ICB are the greater level courses that we find at Upper Intermediate level and Advanced level. So that suggests these two courses:

- National Diploma: Technical Financial Accounting (NQF Level 5).

- National Diploma: Financial Accounting (NQF Level 6).

Foundation Level.

The foundation level is the beginning point for many trainees. If you did not do that well at school, or you failed matric, or you have actually not studied for several years, then the foundation level assists you bridge the gap and get back into studying.

Academically the level is NQF 3. That is the level listed below matric, so we know that trainees with Grade 10 (Standard 8) will have the ability to deal with the scholastic level of the work.

You do not require any previous accounting or accounting understanding if you start at this level. And you have to be at least 16 years of age to be accepted onto the programme.

To finish this level you must pass 4 topics. The recommended time to finish this level is 12 months. Distance learning students can take up to 18 months.

Intermediate Level.

The intermediate level are for trainees who have actually successfully finished the foundation level. It is your 2nd action on the ladder to ending up being a Financial Accountant.

To enter this level, you need to have passed the foundation level. That implies you should currently have your National Certificate: Accounting to enter this level.

To complete this level you need to pass two subjects. Numerous trainees complete this level in six months. Distance learning trainees can take up to 9 months to finish this level.

Upper Intermediate Level.

AT this level you move from Accounting to Accounting. If your dream is to end up being an Accountant, then this level will get you there!

To enter this level you should have passed the Intermediate level. That suggests you must have your FET Certificate: Bookkeeping to get entry to the Upper Intermediate Level.

To complete this level you need to pass 2 topics. The suggested time of study is 6 months. Distance learning trainees can use up to 9 months to finish this level.

Advanced Level.

This is the leading level of ICB studies. Here you will acquire your National Diploma: Financial Accounting (NQF Level 6). To enter this level you must have passed all the previous levels. So that implies you should be in ownership of your National Diploma: Technical Financial Accounting.

To pass this level you should effectively complete four topics. Trainees generally take around 12 months to finish this level. Distance learning students can take a bit longer, of course.

What qualifications do you get?

At the different levels you get various qualifications. You get your certifications from FASSET. And you likewise get certificates from the ICB for every level that you advance.

The certifications are called as follows:.

- Foundation Level Certification.

- National Certificate: Bookkeeping (NQF Level 3).

- Intermediate Level Qualification.

- FET Certificate: Bookkeeping (NQF level 4).

- Upper Intermediate Level Credentials.

- National Diploma: Technical Financial Accounting (NQF level 5).

- Advanced Level Certification.

- National Diploma: Financial Accounting (NQF level 6).

Study further after finishing the ICB Financial Accounting Programme

The ICB offers five different fields of study. Thus far we have discussed just among these disciplines, being: Financial Accounting, or Bookkeeping.

The other disciplines are:

- Public Sector Accounting

- Business Management

- Entrepreneurship

- Office Administration

- The various programmes have many topics in common. So as soon as you have completed one program, you might discover that you can attain another credentials by simply doing the subjects that does not overlap.

For example, three of the first four topics in each of these programmes are the same. So if you have actually passed the 4 topic for your Bookkeeping program, you have likewise finished three of the four subjects you need for the general public Sector Accounting programme. So by including that a person subject, you qualify for another complete credentials.

Study further after finishing your programme – Other Courses

The ICB has acknowledgment contracts in place with a variety of other professional bodies. So, depending upon exactly what certification you have completed with the ICB, you can get credits to qualifications with these bodies.

Here are a list of some of the bodies that will recognise your ICB qualifications as counting to some of their programmes, as well as to membership of these professional bodies:

- Institute of Accounting and Commerce (IAC).

- South African Business Accountants (SAIBA).

- South African Institute for Tax Professionals (SAIT).

- Chartered Institute of Management Accountants (CIMA).

Note: You will have to apply to these professional bodies. And they each have their own set of entrance requirements and rules.

The function of your college and the function of the ICB – who does exactly what?

Your college or academy provides you with the study products, marking, tutoring and all the aid you have to prepare you for the test. Your college helps you finish your Portfolio of Evidence. And will continue pushing you, so that you complete the course successfully and in an affordable quantity of time. We keep you working, studying and motivated!

Then you write the test (and hand in your Portfolio of Evidence) with the ICB. The ICB supervises the quality of the programme. They accredit the course providers, to guarantee that students get great training and has a genuine chance of passing the examinations.

How does Home Study or Distance Learning work for these courses?

Depending upon your college, you may do your course via distance learning, home study, part-time study, or online study. These are all different variations of studying at home, with the help of a college and a tutor that guides you through your programme.

The very best colleges will guarantee you get the right study material, bit by bit, and sent with a carrier. So that your study product gets to you quickly.

Distance Learning.

Studying ICB courses via distance learning is for individuals who can not participate in classes. So if you stay far away from a school where they provide ICB courses, then you must think about distance learning.

Distance learning ways that your course provider sends you books and study notes. And then assists you study over the phone, or email or some online system.

Home Study.

Home study is for students who can not go to classes. Much of our trainees need to work to make a wage in the daytime, so they only get to study after hours and on weekends.

The ICB courses were established so that you can study them from home. The study product gets along and will assist you through the work step by step. When you utilize the study products, you will “hear the voice of the lecturer”. The speaker has actually been written into the course products.

When you require a friendly voice to discuss your studies, you can call the college. Or you can engage with fellow students and your speakers in our online study groups. This is where you can learn the most … seeing the questions of other trainees, and how the tutors address those concerns.

If you have to speak with your tutor individually, you can likewise do that. The online study groups also enable you to have private conversations.

Another way that these courses consider the needs of a home study students, is that there are five test sessions in 2017. So if you can not make a test session, you understand that another opportunity to compose that exam will come around in three months or less. You can also utilize the several exam sessions every year, to advance through your course much faster than the other students. As quickly as you are ready to compose an exam, you will be close to the next examination session.

Part Time Study.

Part time study is for students who can attend some classes, however very few. So you might go to a class at night or on a Saturday. Then study from home the remainder of the time.

Online Study.

Online study means that a lot of your interactions happen on the internet. With our online study groups, we have developed a chat-group environment where you can gain from your tutors and from other students.

ICB Courses at Unisa.

Trainees frequently ask if they can study ICB Bookkeeping at Unisa. This is particularly trainees who wish to go on and study a degree later on.

Regrettably Unisa does not offer any of the ICB courses. If you prepare to study a degree at Unisa, ensure you consult them if they will accept any of your ICB studies for scholastic credits or for entry onto their degree programs.

Each university has its own guidelines. So if you prepare to study further at a university, make definitely sure you understand how they will recognise your prior studies. Many universities will not give you scholastic credits for other studies. They normally just want to see your matric certificate. Yes, I understand this does not make sense!

ICB Course Costs.

Your ICB Accounting course will involve a variety of costs. So make sure you understand all the different things you will need to pay; before you sign up for the course. A few of these things are:

- College fees with your accredited training provider. Also called course costs.

- Textbook costs. Keep in mind to examine exactly what books you will have to purchase for your course; and if your college include these books with your study fees.

- Examination charges. Also, when you register for the exam you will have to pay your trainee registration cost to the ICB.

- ICBA Trainee Membership costs, if decide to join the ICBA. We suggest that you join them as soon as you can.

The Institute of Certified Bookkeepers and Accountants (ICBA).

The ICBA is a professional body that offers subscription to trainees studying ICB courses. Initially you can just become a Student Member. But as quickly as you have finished your very first qualification, you will be qualified for Professional Subscription.

This implies you get to use a professional designation behind your name on your business card. In this way you show your colleagues and your customers that you are serious about your profession, and that you are acknowledged as a professional by the ICBA.

The different qualifications cause various classifications. So make certain to learn more about the ICBA early on in your studies. This is a fantastic way to boost your CV and your professional status.

Last Updated: March 17th, 2017.