Short Courses in Payroll Unisa Home Study

Searching for Short Courses in Payroll Unisa? Pick from this list of Payroll and Accounting courses.

- Payroll and Month-to-month SARS Returns – ICB Short Course

- National Certificate: Accounting (NQF Level 3)

- FET Certificate: Accounting (NQF level 4)

- National Diploma: Technical Financial Accounting (NQF level 5)

- National Diploma: Financial Accounting (NQF level 6)

Payroll and Month-to-month SARS Returns – ICB Short Course.

This skills program will revise the manual month-to-month bookkeeping function. It will introduce students to payroll and the Basic Conditions of Employment Function as well as basic business ethics. Learners will be able to complete the payroll function from the bookkeeping point of view. A learner will have the ability to complete the SARS payroll returns (EMP201, IRP 5, IT3a, IRP501). Learners will likewise have the ability to complete the VAT201 return.

How will this course be structured?

In order to finish the Junior Accounting Payroll and Monthly SARS Returns course, students will need to finish all the following topics:

- Organise, execute, monitor and deal with in payroll

- Learning Module 1: Standard Accounting and BARREL

- Learning Module 2: Strategy, Learning

- Learning Module 3: Record and confirm input variations on employees records

- Learning Module 4: Standard conditions of staff members

- Learning Module 5: Statuary registrations

- Learning Module 6: Complete PAYE documents

- Learning Module 7: Accounting for Payroll

- Learning Module 8: Computerised Payroll

- Learning Module 9: Monthly SARS return and e-filing

- Learning Module 10: Ethics and the signed up tax specialist

How will I be examined?

Once you have successfully finished the necessary projects prescribed by.

Skills Academy, you will have to effectively pass tests with the ICB.

In order to write examinations with the ICB you will need to:

- Apply to the ICB and register with them to compose their tests

- Submit a Portfolio of Evidence to the ICB on the day of your tests

How long is the course?

7– 9 months.

What certificate will I get?

You will be awarded with a Short Course Certificate from Skills Academy. You will likewise be issued by the ICB with a Declaration of Proficiency revealing the particular System Standards that you have finished. FASSET will award you with an Unit Standard Certificate for any System Standards that you have completed.

As Skills Academy values education and appreciates our trainees, your conclusion award will be sent out to you via courier so that you receive it as soon as possible and without any hold-ups.

ICB Bookkeeping Courses – Study with the Institute of Certified Bookkeepers.

The Institute of Certified Bookkeepers use a variety of bookkeeping courses. You can start at an academic level listed below Matric, and work you method approximately 2 levels higher than Matric (NQF 6 level).

To understand the ICB Bookkeeping courses, you need to consider the following:

- Why study Accounting?

- Can I study ICB Accounting courses if I do not have Matric?

- The distinction in between Accounting and Accounting Courses

- The different levels of study with the ICB

- The various courses that comprises the ICB Financial Accounting Programme

- Foundation Level

- Intermediate Level

- Upper Intermediate Level

- Advanced Level

- What qualifications do you get?

- Study further after finishing your program

- Topics that are the same throughout more than one ICB course

- The function of your college and the role of the ICB – who does what?

- How does Home Study or Distance Learning work for these courses?

Why Study Accounting?

In South Africa accounting and accounting are scarce skills. That indicates that both industry and government recognise that we have a shortage of bookkeepers and accountants. The federal government body for qualifications in the financial sector, FASSET, has actually done a study on scarce skills in 2015. From that study they published their Scarce Skills Guide 2015.

FASSET is the SETA for Finance, Accounting, Management Consulting and other Financial Providers. In their scarce skills guide they recognized the following as scarce skills:

- Student Accountant

- Finance Manager

- General Accountant

- Accounts Clerk

- Payroll Clerk

- Debt Collector

These are all positions for which an ICB accounting course will prepare you correctly. Your bookkeeping qualification will guarantee that you are always in demand. It is a terrific career that can take you to the highest level in an organisation.

The shortage of bookkeeping skills likewise impacts federal government departments. All government departments have accounting and bookkeeping departments. And they work every year to obtain a “clean audit”. To obtain a clean audit suggests that they need well-trained, certified, devoted and experienced accounting and accounting staff and managers.

As a certified bookkeeper or accountant, you will constantly remain in need. Either in private business, or in a government department, which can include both towns, as well as bigger national federal government departments.

Can I study ICB Accounting courses if I do not have Matric?

The accounting courses begin at NQF level 3. And they go up to NQF level 6. Matric is at NQF level 4. So these courses are accessible for trainee who do not have Matric. You begin at a scholastic level below Matric. And if you keep studying, you will end up with a qualification two levels above Matric.

The ICB courses are developed to be available for students who need to work and study at the same time. With distance learning you can study an hour every evening. You now have five test opportunities each year, so as quickly as you are ready for a test, you can go and write that test. In this way you can do your course step by step.

As you advance with the programme, you will get acknowledgment at the different levels. After finishing the very first four subjects, you will currently get your very first qualification from FASSET, and your very first ICB Programme Certificate.

The various Levels of study with the ICB.

The ICB bookkeeping program is divided into various levels. Inside each level can be several courses. The program is divided into 4 levels, as follows:

- Foundation Level

- Intermediate Level

- Upper Intermediate Level

- Advanced Level

As you complete each level, you will get recognition from the ICB through an ICB Programme Certificate. As you finish the various courses inside the levels, you will get recognition from FASSET through your official qualification from FASSET.

I shall discuss the various levels, and the courses inside each level, in detail listed below.

The different Courses that makes up the ICB Financial Accounting Program.

The ICB Accounting/ Financial Accounting Program is broken into four levels. Inside each level is one complete qualification. As you progress up the ladder of qualifications, you will see the names of the qualifications alter from Accounting to Accounting.

The ICB Financial Accounting Program consist out of four different levels, each with a FASSET qualification inside it; as follows:

- Foundation level – National Certificate: Accounting (NQF Level 3)

- Intermediate level – FET Certificate: Accounting (NQF level 4)

- Upper Intermediate level – National Diploma: Technical Financial Accounting (NQF level 5)

- Advanced level – National Diploma: Financial Accounting (NQF level 6)

Bookkeeping Courses.

In the ICB, we refer to the Foundation and Intermediate level courses, as Bookkeeping courses. So that will be these 2 qualifications:

- National Certificate: Bookkeeping (NQF Level 3)

- FET Certificate: Accounting (NQF Level 4)

Accounting Courses.

Accounting courses in the ICB are the higher level courses that we find at Upper Intermediate level and Advanced level. So that means these two courses:

- National Diploma: Technical Financial Accounting (NQF Level 5)

- National Diploma: Financial Accounting (NQF Level 6)

Foundation Level.

The foundation level is the beginning point for many trainees. If you did refrain from doing that well at school, or you failed Matric, or you have actually not studied for several years, then the foundation level assists you bridge the gap and return into studying.

Academically the level is NQF 3. That is the level below Matric, so we know that students with Grade 10 (Standard 8) will be able to cope with the scholastic level of the work.

You do not need any previous accounting or bookkeeping knowledge if you begin at this level. And you have to be at least 16 years of age to be accepted onto the program.

To finish this level you should pass four subjects. The suggested time to finish this level is 12 months. Distance learning students can use up to 18 months.

Intermediate Level.

The intermediate level are for students who have actually successfully completed the foundation level. It is your second step on the ladder to becoming a Financial Accountant.

To enter this level, you need to have passed the foundation level. That implies you need to currently have your National Certificate: Bookkeeping to enter this level.

To finish this level you need to pass two subjects. Many trainees complete this level in six months. Distance learning students can use up to nine months to complete this level.

Upper Intermediate Level.

AT this level you move from Accounting to Accounting. If your dream is to become an Accountant, then this level will get you there!

To enter this level you need to have passed the Intermediate level. That indicates you must have your FET Certificate: Bookkeeping to get entry to the Upper Intermediate Level.

To finish this level you need to pass two subjects. The advised time of study is 6 months. Distance learning trainees can use up to 9 months to complete this level.

Advanced Level.

This is the leading level of ICB research studies. Here you will get your National Diploma: Financial Accounting (NQF Level 6). To enter this level you need to have passed all the previous levels. So that means you must be in possession of your National Diploma: Technical Financial Accounting.

To pass this level you need to successfully complete four subjects. Trainees normally take around 12 months to complete this level. Distance learning trainees can take a bit longer, obviously.

What qualifications do you get?

At the various levels you get various qualifications. You get your qualifications from FASSET. And you also get certificates from the ICB for every level that you advance.

The qualifications are named as follows:

- Foundation Level Qualification

- National Certificate: Bookkeeping (NQF Level 3)

- Intermediate Level Qualification

- FET Certificate: Bookkeeping (NQF level 4)

- Upper Intermediate Level Qualification

- National Diploma: Technical Financial Accounting (NQF level 5)

- Advanced Level Qualification

- National Diploma: Financial Accounting (NQF level 6)

Study additionally after completing the ICB Financial Accounting Programme.

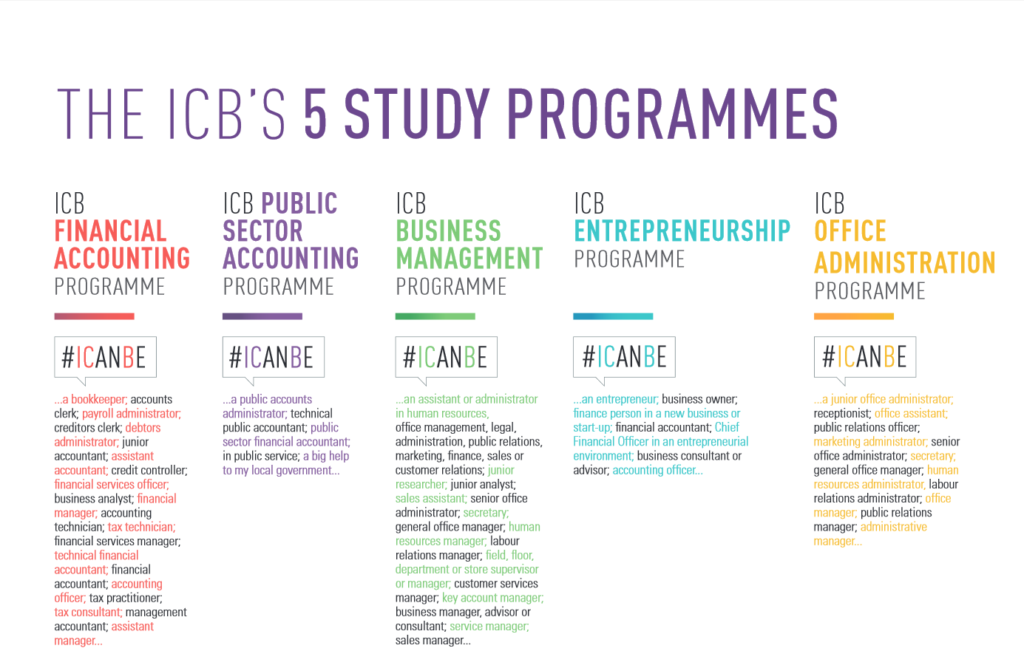

The ICB provides five different disciplines. Thus far we have actually talked about simply among these disciplines, being: Financial Accounting, or Bookkeeping.

The other disciplines are:

- Public Sector Accounting

- Business Management

- Entrepreneurship

- Office Administration

The different programs have lots of subjects in common. So when you have completed one programme, you may find that you can attain another qualification by just doing the subjects that does not overlap.

For example, three of the first four topics in each of these programs are the same. So if you have actually passed the four topic for your Accounting programme, you have actually also completed three of the 4 topics you need for the general public Sector Accounting programme. So by including that one topic, you qualify for another complete qualification.

Study further after finishing your programme – Other Courses.

The ICB has acknowledgment contracts in place with a variety of other professional bodies. So, depending on what qualification you have completed with the ICB, you can get credits towards qualifications with these bodies.

Here are a list of a few of the bodies that will recognise your ICB qualifications as counting to some of their programmes, as well as towards subscription of these professional bodies:

- Institute of Accounting and Commerce (IAC)

- South African Business Accountants (SAIBA)

- South African Institute for Tax Professionals (SAIT)

- Chartered Institute of Management Accountants (CIMA)

Keep in mind: You will have to apply to these professional bodies. And they each have their own set of entrance criteria and rules.

The function of your college and the role of the ICB – who does what?

Your college or academy offers you with the study products, marking, tutoring and all the help you have to prepare you for the test. Your college helps you complete your Portfolio of Proof. And will keep pressing you, so that you finish the course effectively and in an affordable amount of time. We keep you working, studying and encouraged!

Then you compose the examination (and hand in your Portfolio of Proof) with the ICB. The ICB manages the quality of the program. They accredit the course providers, to guarantee that trainees get great training and has a real opportunity of passing the examinations.

How does Home Study or Distance Learning work for these courses?

Depending upon your college, you might do your course by means of distance learning, home study, part-time study, or online study. These are all different variations of studying at home, with the help of a college and a tutor that guides you through your programme.

The very best colleges will ensure you get the right study material, bit by bit, and sent with a courier. So that your study product gets to you rapidly.

Matric College offers its students the opportunity to study from anywhere in South Africa, via distance learning. This means that you are able to earn while you learn. Matric College was born of the belief that every person deserves the opportunity to achieve their Matric, no matter what their age. In saying this, Matric College offers various courses, both accredited and non-accredited, to help students achieve their academic goals.

Distance Learning.

Studying ICB courses via distance learning is for individuals who can not attend classes. So if you stay far away from a campus where they use ICB courses, then you should consider distance learning.

Distance learning methods that your course provider sends you books and study notes. Then helps you study over the phone, or e-mail or some online system.

Courses Offered At Matric College

- Financial Accounting

- National Certificate in Junior Bookkeeping

- FET Certificate in Senior Bookkeeping

- National Diploma in Technical Financial Accounting

- National Diploma in Certified Financial Accounting

- Business Management

- Small Business Financial Management: ICB National Certificate

- Business Management Office Administration: ICB Higher Certificate

- Business Management Financial Accounting: ICB National Diploma

- Office Administration

No Matric? No problem! You can apply to do your Online Matric via distance learning at Matric College. The Matric Courses on offer are:

- Matric Rewrite

- Matric Upgrade

- National Senior Certificate or Senior Certificate (Amended) depending on your age when you complete your studies

- Adult Matric

- Senior Certificate (Amended)

Matric College also offers NATED courses via distance learning. These NATED courses consist of Management courses, Business Management, Financial Management and other necessary skills that can offer you fantastic opportunities if you want to advance your career prospects by giving you the chance of earning a National Diploma qualification in one of the following streams:

- Business Management Courses

- Educare Courses

- Financial Management Courses

- Human Resource Management Courses

- Legal Secretary Courses

- Management Assistant Courses

- Marketing Management Courses

Home Study.

Home study is for trainees who can not go to classes. A lot of our students have to work to make a wage in the daytime, so they just get to study after hours and on weekends.

The ICB courses were developed so that you can study them from home. The study material is friendly and will assist you through the work step by step. When you use the study products, you will “hear the voice of the speaker”. The speaker has been composed into the course products.

When you need a friendly voice to discuss your research studies, you can call the college. Or you can engage with fellow trainees and your lecturers in our online study hall. This is where you can find out the most … seeing the concerns of other trainees, and how the tutors answer those concerns.

If you have to speak to your tutor one-on-one, you can also do that. The online study groups also enable you to have private conversations.

Another manner in which these courses take into consideration the needs of a home study trainees, is that there are five test sessions in 2017. So if you can not make an exam session, you understand that another opportunity to write that exam will happen in three months or less. You can likewise utilize the numerous exam sessions every year, to advance through your course quicker than the other students. As quickly as you are ready to write an exam, you will be close to the next examination session.

Part Time Study.

Part-time study is for trainees who can participate in some classes, but few. So you might go to a class in the evening or on a Saturday. Then study from home the remainder of the time.

Online Study.

Online study indicates that a lot of your interactions occur on the internet. With our online study groups, we have actually created a chat-group environment where you can learn from your tutors and from other trainees.

ICB Courses at Unisa.

Trainees frequently ask if they can study ICB Accounting at Unisa. This is especially students who wish to go on and study a degree later.

Regrettably Unisa does not use any of the ICB courses. If you intend to study a degree at Unisa, ensure you contact them if they will accept any of your ICB studies for scholastic credits or for entry onto their degree programs.

Each university has its own guidelines. So if you intend to study further at a university, make definitely sure you understand how they will recognise your previous research studies. The majority of universities will not offer you academic credits for other studies. They normally just want to see your matric certificate. Yes, I understand this does not make sense!

ICB Course Costs.

Your ICB Bookkeeping course will entail a number of costs. So make certain you understand all the different things you will need to pay; prior to you sign up for the course. A few of these things are:

- College costs with your recognized training service provider. Likewise referred to as course charges

- Textbook costs. Keep in mind to examine what books you will need to buy for your course; and if your college consist of these books with your study costs

- Exam fees. Also, when you sign up for the exam you will have to pay your trainee registration fee to the ICB

- ICBA Trainee Membership fees, if choose to join the ICBA. We advise that you join them as quickly as you can

The Institute of Certified Bookkeepers and Accountants (ICBA).

The ICBA is a professional body that provides subscription to trainees studying ICB courses. Initially you can only end up being a Student Member. However as soon as you have completed your very first qualification, you will be qualified for Professional Subscription.

This implies you get to utilize a professional classification behind your name on your business card. In this way you reveal your colleagues and your clients that you are serious about your occupation, which you are recognised as a professional by the ICBA.

The various qualifications result in various designations. So make sure to discover more about the ICBA early on in your studies. This is a great way to enhance your CV and your professional status.

Last Updated: 11 January 2022